AgriStability

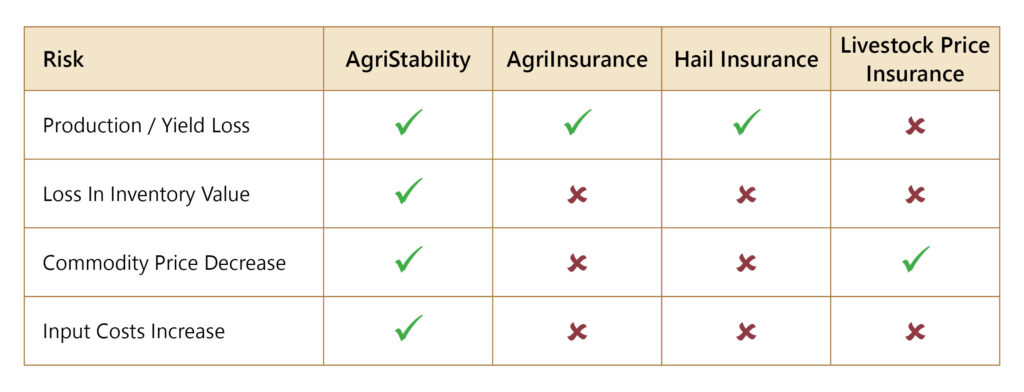

AgriStability protects against production loss, increased input costs, and changing market conditions—covering the full spectrum of risks that can reduce farm profitability.

It’s a comprehensive safety net that works alone or alongside other tools like crop insurance and Livestock Price Insurance—helping you protect your investment and your livelihood. It’s a practical, affordable program that protects farm income when profit margins take a hit.

If a farm’s profitability drops below 70 per cent of its historical average, AgriStability steps in. The program covers 80 cents for every dollar lost, up to 70 per cent of the historical average or a maximum of $3 million. This whole-farm approach makes AgriStability different from other risk management tools—it looks at the entire operation, not just one crop or commodity.

AgriStability is offered as part of the Sustainable Canadian Agricultural Partnership between the province and the federal government.

Why Choose AgriStability?

Whole-farm protection – AgriStability helps when your farm’s overall profitability is at risk. It triggers when your margin drops below 70 per cent of your historical average due to production loss, increased input costs, or changing market conditions.

Unique coverage – Your coverage is based on your own farm history.

Access to other credit options and programs – AgriStability can give you access to credit options such as the Advance Payments Program (APP), which provides cash advances through various farm commodity organizations.

Affordable protection – AgriStability is a low-cost risk management program available to all producers.

How does it work?

Benefits are calculated by comparing a participant’s current year financial information to historical years to determine if there has been a shortfall. Historical years may also be adjusted to better reflect the current year’s productive capacity or commodity mix.

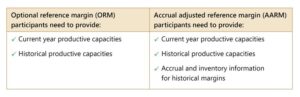

Participants enrolling in the program can choose how they want to file the information for their historical years, selecting either the optional reference margin (ORM) or the default accrual adjusted reference margin (AARM).

The optional reference margin is based on tax-reported income, eliminating the need for inventory or accrual records. On the other hand, the accrual adjusted reference margin considers inventory, payables, purchased inputs, and deferrals; however, the added information increases the precision of the program.

Participants can request a coverage notice during the program year to better understand their estimated support level. Additional information is required; what’s needed depends on the calculation method selected.

Recent improvements

AgriStability has undergone several improvements over the past few years, including:

- It’s easier to participate: New participants now need only three years of historical information instead of five to enrol in the program, and they can opt for an optional reference margin based on tax-reported income, eliminating the need for inventory or accrual records.

This flexibility is helpful for smaller farms seeking simplicity, while larger operations may prefer the default accrual adjusted reference margin for greater precision - More responsive for livestock producers: While decreased prices and market corrections can affect all commodities, livestock operations face unique challenges, prompting changes aimed at making coverage more responsive to the realities of livestock production.

- Starting in 2026:

- Rent on grazing acres will count as an allowable expense.

- The valuation of opening and closing inventories for eligible crops fed on farm will be based on the fair value at the end of the year.

- Starting in 2026:

- Increase in compensation rate: The AgriStability compensation rate increased to 80 per cent or 80 cents per dollar of support from the previous 70 per cent rate. The trigger for program benefits remains at 70 per cent of the participant’s historical average.

- Removal of the reference margin limiting: Reference margin limiting (RML) was removed, making AgriStability more transparent and responsive.

Interim advances

Producers enrolled in AgriStability are eligible to apply for an advance on their AgriStability payment. New participants may be able to apply for an interim advance payment as long as they are enrolled and have paid the program fee.

To be eligible for an AgriStability interim advance, a producer must:

- Have completed six months of consecutive farming activity and a production cycle.

- Be farming in Canada

- Have reported farming income to Canada Revenue Agency (CRA) as an individual, corporation/co-operative or a trust/communal organization

- Have paid their AgriStability fee

Sustainable Canadian Agricultural Partnership

The Sustainable Canadian Agricultural Partnership (Sustainable CAP) is a $3.5-billion, five-year agreement, which runs April 1, 2023 to March 31, 2028.

This agreement between the federal, provincial and territorial governments strengthens the competitiveness, innovation, and resiliency of the agriculture, agri‐food and agri‐based products sector. It includes $1 billion in federal programs and activities and $2.5 billion in cost-shared programs and activities funded by federal, provincial and territorial governments.

If you are new to AgriStability or have been out of the program for four or more years, you will need to complete a few easy steps to be enrolled in the program.

Learn MoreFrequently Asked Questions

Sustainable Canadian Agricultural Partnership (Sustainable CAP) is the new five year federal-provincial-territorial agricultural agreement in effect as of April 1, 2023. The agreement covers AgriStability program years 2023-2027.

Under Sustainable CAP, the AgriStability compensation rate has increased to 80 per cent or 80 cents per dollar of support from the previous 70 per cent rate. This change is in effect for the 2023 program year.

What hasn’t changed is the benefit trigger point or how fees are calculated – benefits still begin to trigger at 70 per cent of the reference margin and it still costs only $315 for every $100,000 of reference margin support. Losses in excess of 30 per cent are now compensated at $0.80 for every dollar of decline.

1. Simplified enrolment for issuance of fees: if there is not enough information in AFSC records to calculate a fee, your fee will be calculated using industry benchmark information based on your estimated program year productive units.

2. Reduced information requirements for calculating a benefit: new participants or participants who have been out of the program for at least four years prior to the program year can choose to supply three years of tax and supplementary information rather than five years. If they choose to submit only three years, their reference margin will be the average of the last three years rather than the five-year Olympic Average.